High prices won’t stop 65% of Virginians from spending at least as much this holiday season as they did last year. Nationally, inflation remains more than 7.5% year over year. Total spending increases with prices and the number of items purchased.

In Virginia this holiday season, the increased spending will be attributed to a little bit of both. Of those spending more this year, more than half say it is because of increased prices, but other reasons include improved employment/financial positions (19%) and generosity (11%.) High prices are also the primary reason for those reporting a reduction in holiday spending. Three-quarters of respondents anticipate higher prices this year.

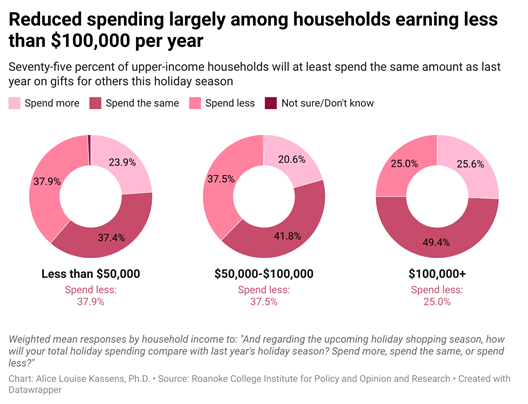

Changes in the distribution of planned spending relative to a year ago vary across household income levels. Seventy-five percent of households earning more than $100,000 a year will spend at least as much as they did in the 2021 holiday season. Spending is expected to fall primarily within households earning less than $100,000 per year. Twenty-five percent of upper-income households plan to reduce holiday spending compared to 37%-38% of middle- and lower-income households.

Changes in the distribution of planned spending relative to a year ago vary across household income levels. Seventy-five percent of households earning more than $100,000 a year will spend at least as much as they did in the 2021 holiday season. Spending is expected to fall primarily within households earning less than $100,000 per year. Twenty-five percent of upper-income households plan to reduce holiday spending compared to 37%-38% of middle- and lower-income households.

Given that most Virginians will spend at least as much as last year, how much will they spend? More than 63 % of Virginians will spend up to $500 total during the 2022 holiday shopping season on gifts for others, down seven percentage points from the 2021 season. Instead, this year, more respondents plan to spend more than $500, with close to 10% planning to spend at least $1,000.

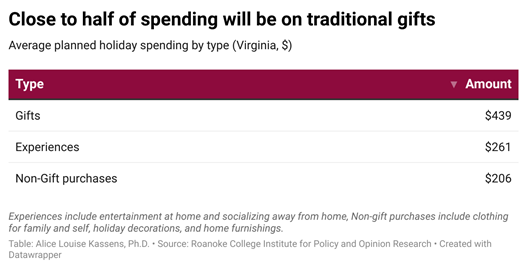

Spending over the holiday season falls into three categories: gifts, experiences (including entertainment at home and socializing away from home), and non-gift purchases (including holiday decorations and home furnishings). On average, Virginians plan to spend $439 on gifts for others, $261 on experiences and $206 on non-gift purchases. The types of items purchased may shift relative to last year because of relative price changes. For example, smartphones, televisions, ship fares and the price of admission to sporting events are down 17.7, 16.5, and 0.6%, respectively, with the price of admission to sporting events down 22.9. In contrast, airfare, candy, women’s apparel and jewelry prices rose by 42.9, 14.2, 6.3, and 2% , respectively. Even goods with increased prices, if less than the overall inflation rate (7.7%), may seem like deals. Wrapping those gifts will also cost more, with the price of gift wrap increasing by 4.2 % over the year.

Spending over the holiday season falls into three categories: gifts, experiences (including entertainment at home and socializing away from home), and non-gift purchases (including holiday decorations and home furnishings). On average, Virginians plan to spend $439 on gifts for others, $261 on experiences and $206 on non-gift purchases. The types of items purchased may shift relative to last year because of relative price changes. For example, smartphones, televisions, ship fares and the price of admission to sporting events are down 17.7, 16.5, and 0.6%, respectively, with the price of admission to sporting events down 22.9. In contrast, airfare, candy, women’s apparel and jewelry prices rose by 42.9, 14.2, 6.3, and 2% , respectively. Even goods with increased prices, if less than the overall inflation rate (7.7%), may seem like deals. Wrapping those gifts will also cost more, with the price of gift wrap increasing by 4.2 % over the year.

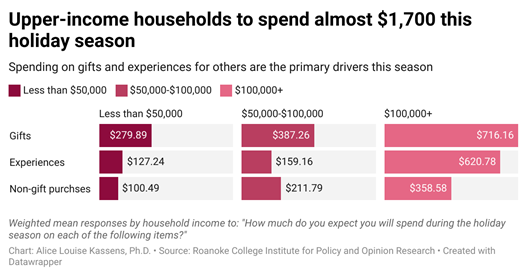

Due to greater resources, upper-income households plan to spend more than those earning less. Households earning more than $100,000 anticipate spending almost $1,700, with more than $716 going to gifts for others and $621 toward experiences. Comparatively, households earning less than $50,000 plan to spend $280 on gifts for others, $127 on experiences and an additional $100 on non-gift purchases.

Due to greater resources, upper-income households plan to spend more than those earning less. Households earning more than $100,000 anticipate spending almost $1,700, with more than $716 going to gifts for others and $621 toward experiences. Comparatively, households earning less than $50,000 plan to spend $280 on gifts for others, $127 on experiences and an additional $100 on non-gift purchases.

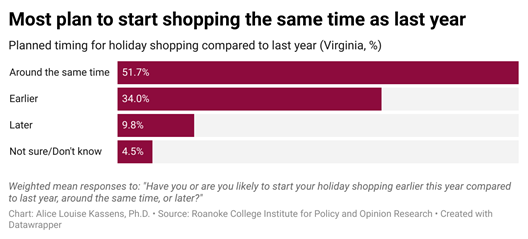

With prices at levels not seen in decades, households might need to spread spending over a more extended period and more paychecks. More than one-third of households say they plan to start shopping earlier this year relative to a year ago, while more than half plan to start around the same time as last year. Respondents plan to do about half of their shopping online, down significantly from last year (70%). This is a good sign for small businesses without a large online presence.

With prices at levels not seen in decades, households might need to spread spending over a more extended period and more paychecks. More than one-third of households say they plan to start shopping earlier this year relative to a year ago, while more than half plan to start around the same time as last year. Respondents plan to do about half of their shopping online, down significantly from last year (70%). This is a good sign for small businesses without a large online presence.

All questions, frequencies and toplines are available on the IPOR web page.