The Virginia Real Estate Indexes held fast to the dips in the last quarter of 2018, although remain strong. Buyers appear frustrated by prices which are currently driven by falling inventories which are down 15 percent over the past year. The Federal Reserve Bank’s recent announcement of a more cautious approach to raising rates will temper mortgage rates but does suggest a rising likelihood of economic recession.

Prices rise, inventories fall

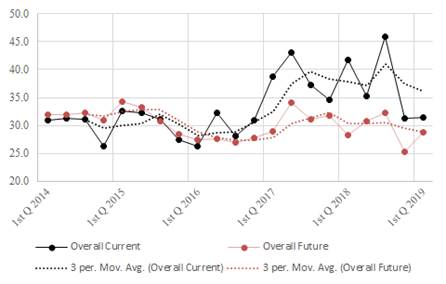

Virginian sentiment about real estate markets changed little moving into 2019. Figure 1 shows the current and future index values for the past five years. The February Current Real Estate Index is 32, meaning that thirty-two percentage-point more Virginians are optimistic about the real estate market today, compared to a year ago, than are pessimistic, and one point off the historic average. When looking ahead to the coming year, Virginians are slightly more optimistic than last quarter. The February Future Real Estate Index is 29, up three and a half points since last quarter and less than three points below the historical average.

Virginian sentiment about real estate markets changed little moving into 2019. Figure 1 shows the current and future index values for the past five years. The February Current Real Estate Index is 32, meaning that thirty-two percentage-point more Virginians are optimistic about the real estate market today, compared to a year ago, than are pessimistic, and one point off the historic average. When looking ahead to the coming year, Virginians are slightly more optimistic than last quarter. The February Future Real Estate Index is 29, up three and a half points since last quarter and less than three points below the historical average.

The real estate indexes are sensitive to market prices. Nationally, the real estate market had a strong winter, a time that is typically slow. Over the past year (January 2018 to January 2019), national home value, median sale price, and for-sale inventories rose 7, 3, and 1 percent, respectively. However, in the Commonwealth, seasonally adjusted for-sale inventories fell by almost 15 percent, while the median sale price increased by $10,800, or 4.2 percent, over the past year. Reduced inventories restrict supply and potentially generate a shortage which increases price.

Respondents who believe that now is a good time to sell a home cite rising incomes, prices, and lower inventories. Forty-seven percent of Virginians believe that today is a better time to sell than a year ago. Figure 2 shows the Current (compared to a year ago) and Future (over the next year) Sellers Real Estate Indexes over time. The dark lines and points are actual data, while the dotted lines are three-quarter moving averages. The latter serves to smooth the data and is less sensitive to periodic fluctuations. There is an upward trend in seller optimism about the future (red) real estate market, although the future is considerably less bright than the present.

Figure 3 provides the same analysis for buyers. Buyers continue their concern about the real estate market both today and in the future, although the trend, at least for the quarter, turned a gentle corner. Thirty-four percent of respondents say that now is a better time to buy a home compared to a year ago, while 25% see the next year as a good time to buy a home. These disparate sentiments between buyers and sellers are driven by one factor: price. Until inventories rise, prices will not fall. Federal Reserve actions and rising interest rates will also add to the total cost of buying a home in the future, although recently the Fed announced a much more cautious approach to raising rates in 2019.

Interviewing for The Roanoke College Poll was conducted by The Institute for Policy and Opinion Research at Roanoke College in Salem, Va. between February 10 and February 20, 2019. A copy of the questions and all toplines may be found on the IPOR website.