The Virginia Index of Consumer Sentiment fell modestly by 2.2 points over the second quarter of 2018, coming in at 95.8, but remains close to its historical high. The dip halts an upswing begun in the final quarter of 2017. The political party gap increased slightly, reaching the second highest value since the 2016 Presidential election.

The Virginia Index of Consumer Sentiment fell modestly by 2.2 points over the second quarter of 2018, coming in at 95.8, but remains close to its historical high. The dip halts an upswing begun in the final quarter of 2017. The political party gap increased slightly, reaching the second highest value since the 2016 Presidential election.

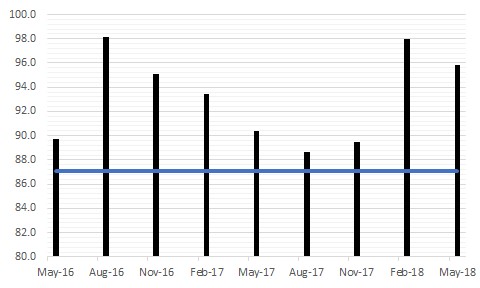

Figure 1. Virginia Consumer Sentiment, past two years (black=VAICS, blue=historical VAICS average)

Consumer sentiment retreats, but still near record high

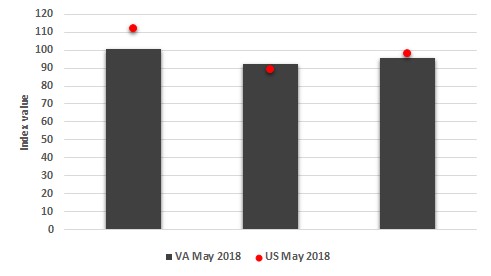

The Virginia Index of Consumer Sentiment (VAICS) retreated from its late 2017 rebound, falling 2.2 points over the last quarter. The national value is 98, also down almost two points since last quarter. Figure 2 shows the current index values for Virginia and the US: current, expectations, and overall sentiment, respectively (left to right.) Both remain near post-recession highs, in keeping with the positive economic and labor market news, and despite stock market volatility and uncertainty about international policy.

Figure 2. May 2018 Virginia and US Indexes of Current Conditions, Consumer Expectations, and Consumer Sentiment (left to right)

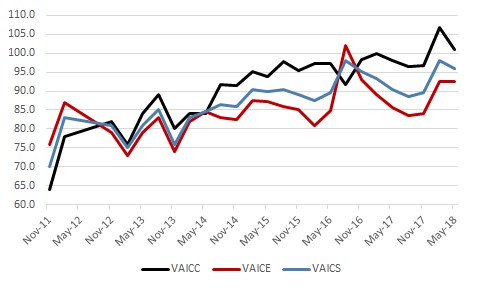

Figure 3 shows the historical values for the VAICS and its two sub-indexes, the Index of Current Conditions (VAICC) and the Index of Consumer Expectations (VAICE). Overall sentiment continues to be driven by beliefs about current economic conditions rather than expectations of the future, although both measures turned downwards last quarter. Consumers overwhelmingly cite rising incomes as the source of positivity in the Commonwealth. Close to 60 percent of respondents report that now is a good time to buy large, durable items, and 42% say their household finances are improved from last year. Although consumer expectations are low relative to current conditions, the VAICE remains well above its average with 45% reporting that they believe their household finances will improve over the coming year, suggesting Virginia’s households expect continued income growth and relatively low prices.

Figure 3. Lifetime values for three Virginia indexes

Party divide grows

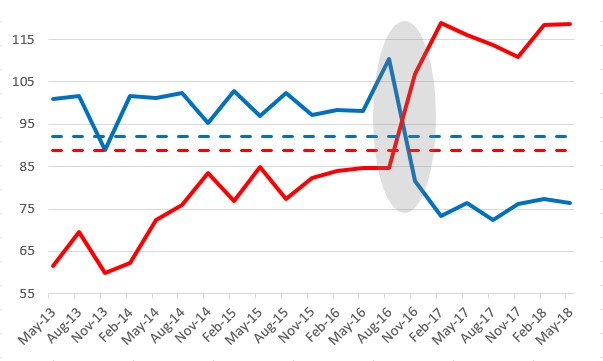

Figure 4 shows the Virginia Index of Consumer Sentiment by party affiliation. Prior to the 2016 presidential election, Democrats were considerably more optimistic about the economy than their right-leaning peers. The party gap closed heading into the election, and flipped afterward. The difference grew to a high of 45 points after the election (February 2017), with Republicans more optimistic than Democrats, but closed slightly after the November 2017 Virginia gubernatorial election. The gap increased again in the second quarter of 2018, reaching the second highest level since the 2016 election (42.4 points.) A similar trend is seen at the national level and suggests that respondent beliefs about the current and future economy depend, in part, upon the parties holding the highest offices and if they match personal affiliations.

Figure 4. Virginia Index of Consumer Sentiment, Democrat and Republican

Note: Lines = Virginia Index of Consumer Sentiment (blue=D, red=R), Dashed Lines = VAICS Historical Average, Grey Shade = Pre- and Post-2016 Presidential Election

Inflation expectations

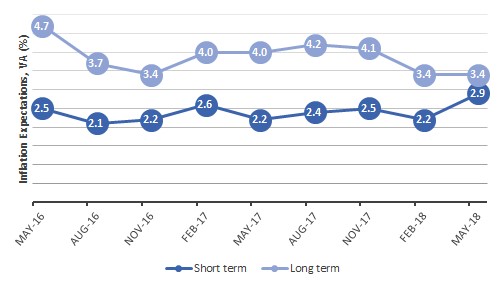

Short-term inflation expectations increased by seven tenths of a point over the second quarter of 2018 in the Commonwealth, while long-term expectations remained at 3.4% as shown in Figure 5. Increased prices at the gas pump, suggestions of incremental rate increases by the Federal Reserve Bank, and rising mortgage rates are well-known and publicized events which are likely driving the expectations. The measures indicate direction of overall price growth anticipated by Virginians over the next year and next 5-10 years, respectively. These expectations are close their historical averages, suggesting respondents are not concerned with abnormal price growth. Price stability is important for investment and retirement planning.

Figure 5. Short and long term inflation expectations

Methodology

Interviewing for The Roanoke College Poll was conducted by The Institute for Policy and Opinion Research at Roanoke College in Salem, Va. between May 20 and May 30, 2018. A total of 605 Virginia residents 18 or older were interviewed. A copy of the questions and all toplines may be found here.