Virginians have weighed in on their opinions of the real estate market for the second time this year. The Roanoke College Poll interviewed 608 Virginians about their opinions of the current market and their expectations for the future. Additionally, respondents indicated their willingness to buy and sell property today and in the coming year. Overall sentiment up, buyers cautious about the coming year

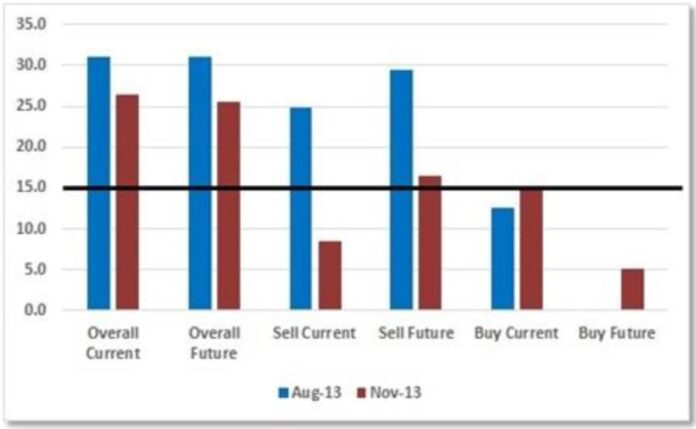

Although sentiment has waned since August, all measures of the real estate market in Virginia are above the point where equal shares of respondents feel optimistic and pessimistic. Figure 1 shows the real estate indexes for the Commonwealth. Overall sentiment is down since August, although still quite strong. More than 57 percent of Virginians believe that the condition of the real estate market has improved since last year, while 49 percent believe that conditions will improve in the next year.

Sale prices and other real estate market outcomes depend upon a variety of factors influencing buyers and sellers. Several positive reports are likely playing a role. The Virginia labor market is considerably stronger than the nation as a whole. The October seasonally adjusted unemployment rate in the Commonwealth was unchanged since September at 5.6 percent, which is well below the national rate of 7.3 percent. Overall prices for goods and services have remained low since the recent economic recession. Housing inventories have risen in recent months in most areas of the Commonwealth.

The Commonwealth’s real estate market is also facing push back. Mortgage rates are rising across the Commonwealth, and are almost 100 basis points higher than a year ago. Credit markets remain tight. The implementation of the Biggert-Waters Flood Insurance Reform Act of 2012 is driving up the cost of flood insurance. Without a legislative delay, rates will continue to rise to actuarial rates over the coming years. Higher rates increase the cost of buying and owning a home. In 2014, property owners previously not required to buy flood insurance may find their properties inside newly redrawn flood zones. Uncertainty about future health insurance rates are likely raising questions about the affordability of homeownership.

Sellers describe growing optimism, while buyers report declining sentiment. Forty-four percent of respondents believe it is a better time to sell today than a year ago. This share falls to 41.5 percent of respondents when asked about selling a year from now. On the other side of the real estate market, 44 percent of buyers believe that today is a better time to buy residential property, compared to a year ago, although only 32.5 percent of buyers consider this to be true in the coming year.

Sellers are confident in Northern Virginia but remain pessimistic in Southwestern Virginia. These differences are largely influenced by varying economic conditions. Northern Virginia sellers of real estate property are extremely positive about current and future conditions. Sixty-three percent of respondents in Northern Virginia report that today is a better time to sell than a year ago, but this falls to 43 percent when asked about selling in the coming year. The optimism in Northern Virginia is in sharp contrast to the pessimism in Southwestern Virginia, where only 26 percent of respondents believe that selling conditions are better today compared to a year ago. When considering selling conditions a year from now, respondents in Southwestern Virginia are slightly more positive as 28 percent report improving conditions.

Residential buyers are significantly more optimistic about conditions today and the coming year in most regions. Southside (51%) and Shenandoah Valley (53%) respondents are particularly confident about buying conditions today compared to a year ago. Still, optimism in these two regions does not persist, falling to 31 and 28 percent, respectively, over the coming year.

The coming changes in flood zones and flood insurance rates will be of particular interest in the coming year, particularly in the Tidewater region. The next Real Estate Index is scheduled for February 2014, after an iteration of the Biggert-Waters Act rate increases and new zoning maps.

Interviewing for The Roanoke College Poll was conducted by The Institute for Policy and Opinion Research at Roanoke College in Salem, November 11-14, 2013.