As published here, Salem resident Diane Ribble has been inquiring since December 2023 about details regarding Salem’s budget process and planning. This commentary contains City of Salem’s Feb. 5 responses to some questions.

In a Feb. 9, 2023 email Ribble asked Crystal Williams, Assistant to the City Manager, “Please help me understand where the Moyer Renovation budget ($27,922,667) is itemized on pg. 96 [of the Salem City budget].”

On Feb. 12, despite Ribble having contacted Ms. Jordan before, Williams emailed Ribble: “Our finance director, Rosie Jordan, is a good resource for you to follow up on your questions related to the budget. She can be reached at 540-375-3061. I have copied Ms. Jordan on this email so she knows you will call to discuss. Have a great Monday!”

As of publication date, Ribble has received no response to her Feb. 17, 2024 follow-up email to Williams, the text of which is below:

“To be clear, I spoke with [Salem Finance Director] Rosie [Jordan] last month. She pulled the figure $27,922,667 for Moyer renovations.

“I read it again in your email. Your page 96 does not reflect this figure (your page 96 shows $23,500,000….[over] $4M difference). Is it unreasonable to expect that your office should respond as to why this doesn’t coincide with the amount you, and Finance, have stated?

“I believe you should be able to reconcile this question/number.

“I began calling City offices in January…my request was twofold.

1. “I wanted to know what the financial arrangements were between City of Salem and Roanoke College…with the onset of use of the football stadium coupled with the extensive renovations at Moyer.

2. “I was seeking a breakdown/allocation of where our taxes go; who could provide that information.

“My quest took me through all seven departments/personnel outlined in my original email. I received scant or differing responses. I was mostly ushered on to someone else for my answers.

“My initial conversation was with Jim Wallace regarding the Roanoke College liaison in December.

“I made calls to the Treasurer’s Office and Commissioner of Revenue. They had nothing for me. I was waved on to other offices that “would know“ those answers; including yours.

“I spoke with Alyson when I first called Finance. She took a message for Rosie to call. I was then sent to Crystal Williams in the City Manager’s office. I had a brief conversation with Crystal, telling me she did not have that information on either request, but Rosie Jordan would have a breakdown of how our taxes are spent, and [Parks and Recreation Director] John Shaner would give me all the details about the Roanoke College financial partnership with our facilities. John and Rosie provided me with different estimates of what would be paid out for Moyer (Shaner $27.5 Million /Jordan $27.923 Million) I was told our real estate and personal property taxes go into a general fund and there is no itemization.

Regarding the fact that “Roanoke College does not charge City of Salem to use their facilities,” I would expect not! They enjoy a tax-exempt status. They are a private institution funded with many sources. We are a public entity funded by taxpayers.

How did you set the arbitrary fee for Roanoke softball to use Moyer field.. $17,000, now $18,500? This is insignificant towards the $28 million and climbing renovations! Especially for a school whose current tuition and residency sits at $54,000 for school year ’24-’25.

I expect the college to pay for their use of and maintenance for our facilities that enhance Salem, on a continuing basis. Roanoke College a has a lot to gain from a strong, safe and fiscally-sound Salem.

They enjoy a multi-faceted partnership with the City of Salem and rely on our infrastructure, attractions and businesses to help attract students and staff.

I look forward to hearing your reconciliation of the estimates on your Budget detail and your quote.

I want to hear how your contract for the college’s use of our football stadium plays out.

As I stated to [Salem Civic Center Director] Wendy Dulano, I would expect for it not to be just mutually beneficial, but financially beneficial to the city of Salem; not a burden to taxpayers.

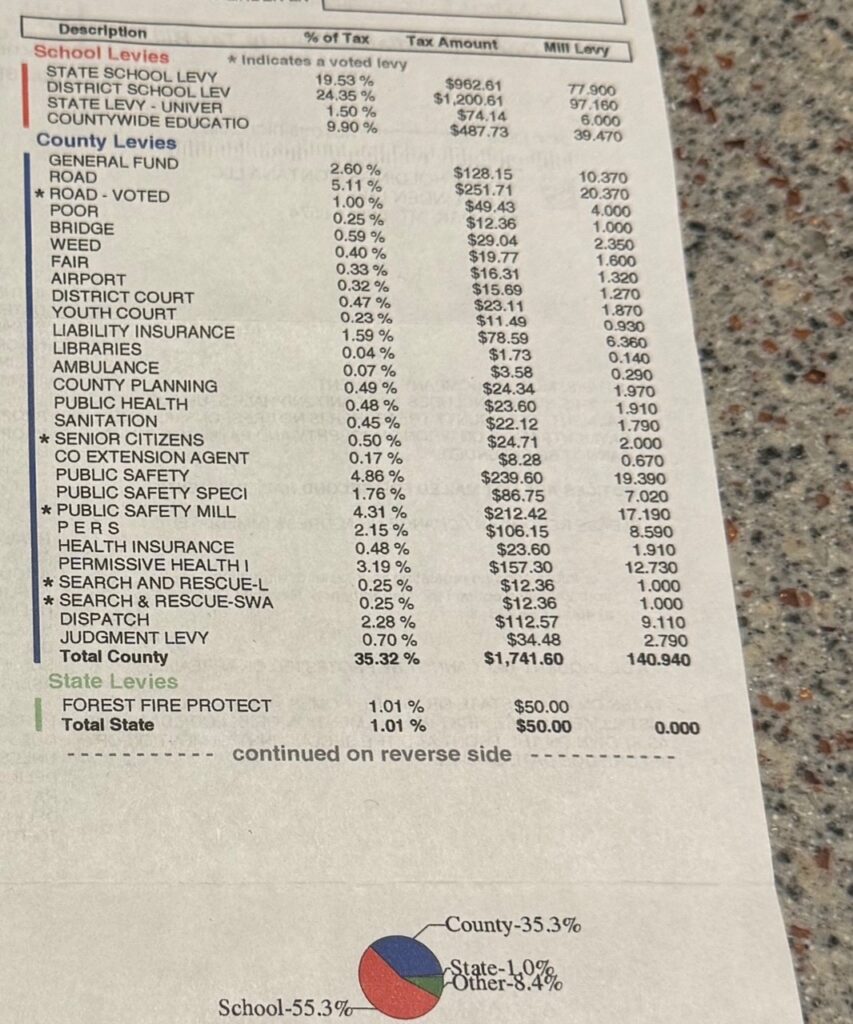

Please see the attachment below illustrating how Lake County, Montana provides transparency and accountability for their taxpayers with this document. I would encourage Salem to consider doing the same.