On Palm Sunday 1865, Robert E. Lee surrendered to Ulysses S. Grant at Appomattox, Virginia, essentially bringing the horrific Civil War to a close. Even though Lee surrendered 159 years ago, the Civil War is still making headlines and occupying the General Assembly’s attention in a way that leads some to ask if we’re still refighting it.

At issue is House Bill (HB) 568 that seeks to strip tax exemption for the historic preservation group United Daughters of the Confederacy (UDC) and their real estate.

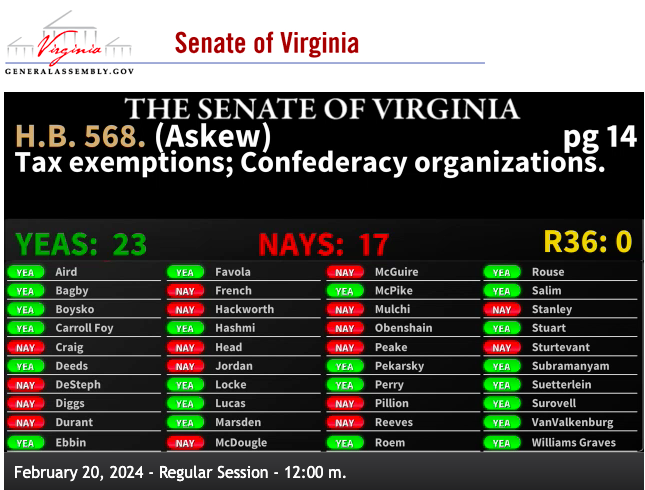

Del. Alex Askew (D-Va. Beach) sponsored the legislation. On Feb. 20 the bill passed the State Senate 23-17 and on Feb. passed the House 54-45. The bill now goes to Gov. Youngkin’s desk for approval or veto.

The two state senators representing our region are both Republicans and generally vote together. In this case, Sen. Suetterlein, who represents all of Roanoke City and parts of Counties of Roanoke and Montgomery, voted with the Democrat majority while Sen. Chris Head did not.

The Roanoke Star reached out to both senators for a statement about their vote but none has been received as of publication time.

Both houses of the General Assembly are under Democrat control.

The bill reads: “Tax exemptions; Confederacy organizations. Eliminates the exemption from state recordation taxes for the Virginia Division of the United Daughters of the Confederacy and eliminates the tax-exempt designation for real and personal property owned by the Virginia Division of the United Daughters of the Confederacy and the General Organization of the United Daughters of the Confederacy.”

There are many arguments for the tax change. Interestingly, it was a Virginia Beach teenager who learned from her attorney father that the UDC enjoyed a unique exemption in the state tax code. Supporters attest that groups with ties to the Confederacy ought not receive preferential treatment.

Del. Askew supported the measure by claiming “Our code should reflect our values and what we want the Commonwealth to be now” and “It doesn’t mention historic organizations like NAACP and other groups that are really moving things and have had connections within our community in pushing what we believe forward.”

Today, HB568 has passed on the Senate floor 23Y 17N. HB568 aims to end the tax exemption for the United Daughters of the Confederacy. This bill unlocks revenue for the Commonwealth to fund schools, workforce development, and mental health programs. pic.twitter.com/RB4IfL8dJp

— Delegate Alex Q. Askew (@AlexAskew757) February 20, 2024

Regarding financial impact, according to this report, “Parrish Simmons, who works in the Richmond Assessor’s Office, wrote in an email that the organization’s Richmond headquarters along Arthur Ashe Boulevard would be subject to the city’s regular tax rate if the bill passes. The assessor valued the property at $4,436,000 in 2024. Richmond taxes property at $1.20 per $100 of assessed value, making the potential property tax bill $53,232 each year.”

Likewise, there are also many arguments against the change. One, any tax revenues from the change will be minimal. Two, with the Civil War having ended generations ago, bringing this up may only further inflame passions, add to the current divisiveness, and seems vindictive. Three, UDC supporters attest they are primarily an historical preservation and educational movement. As explained in their purpose statement: “The United Daughters of the Confederacy totally denounces any individual or group that promotes racial divisiveness or white supremacy. And we call on these people to cease using Confederate symbols for their abhorrent and reprehensible purposes.”

Moreover, some have been mocked by warning that attacks on Confederate history and memorials are simply part of a larger assault on American history. Yet, those warnings have proven true; one example is the 2021 removal of a statute of President and UVA Founder Thomas Jefferson from New York City Hall after 187 years.

Hence, opponents of the new legislation ask, once the UDC is setback, what other historic group, property or statue will be targeted next?

Demonstrating the complicated relationship between the past and present in Virginia, Sen. Tim Kaine pushed to rename all US military installations with Confederate names, but in an ironic twist that has received scant media attention, for 28 years owned a home on Richmond’s Confederate Avenue.

The 2024 General Assembly is scheduled to adjourn on March 9.

Go Deeper: United Daughters of the Confederacy public statement about tax status.

-Scott Dreyer