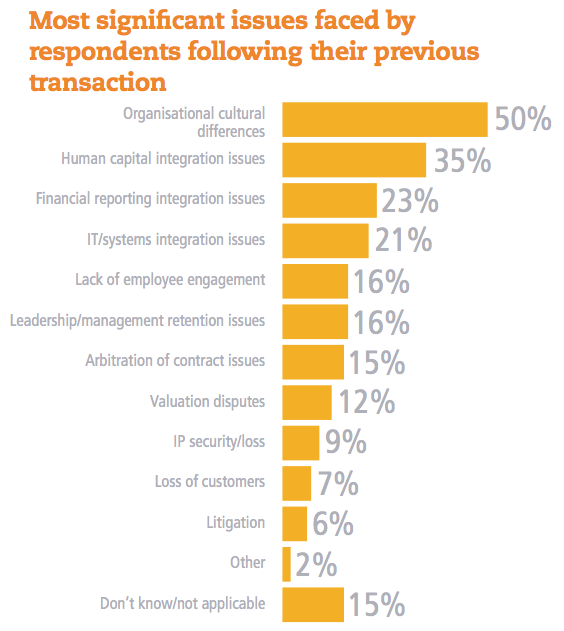

Mergers and acquisitions 2023 are complex, even more so when crossing borders. The thing is, each party to the transaction has a unique organizational culture, different from the other. Perhaps this diversity wouldn’t seem so important if it were not the reason for 50% of all M&A failures.

Our post will provide real-life examples of M&A deals that fell through due to cultural differences (the wise man learns from the mistakes of others!). Additionally, we will share some valuable insights on navigating diversity to avoid stress and losses.

3 examples of M&A failures due to cultural issues

Here are some remarkable examples of how cultural incompatibility has caused failures for world-famous corporations.

1. Amazon and Whole Foods

The Amazon-Whole Foods merger represented vertical integration, one of the main types of mergers and acquisitions, which allowed Amazon to sell products in hundreds of Whole Foods stores beyond the e-commerce realm. Whole Foods, in turn, aimed to drive lower prices and economies of scale following their recent market downturn.

However, incompatible corporate cultures resulted in suboptimal results for the merged organization since the leaders failed to assess their cultural fit properly. Amazon’s efficiency- and technology-focused culture couldn’t harmonize with Whole Foods’ more people-focused approach, which presented a challenge for the partnership.

2. Hewlett-Packard (HP) and Compaq

The merger of Hewlett-Packard and Compaq seemed promising since both companies produced high-quality and well-known products. However, the cultural mismatch between HP’s consensus-based engineering culture and Compaq’s sales-oriented and quick-decision culture led to a loss of approximately $13 billion in market capitalization.

Fortunately, companies managed to survive by making significant leadership and cultural changes, ultimately leading to long-term success and growth.

3. Daimler-Benz and Chrysler

The Daimler-Benz and Chrysler M&A is one of the most striking examples of how completely different cultures can lead to failure. While Daimler-Benz’s focus was methodical decision-making, Chrysler preferred a more creative approach. Moreover, Daimler-Benz adhered to a culture of conservative salaries, while Chrysler’s policies reflected America’s booming chronic capitalism.

Daimler eventually sold 80% of Chrysler’s stakes to Cerberus Capital Management for US$7 billion. Furthermore, the deal caused Daimler to suffer significant financial losses and Chrysler to lose $29 billion in value.

As you can see, cultural incompatibility can be anything from suboptimal results to multi-billion dollar losses. Therefore, we offer practical tips below to help you turn diversity into strength!

For you to read! Check out the collection of the best merger and acquisition books for deep insights into the M&A world.

How to overcome cultural issues in M&A?

Follow our simple but reliable strategies and begin your M&A journey with more confidence.

1. Due diligence in mergers and acquisitions

Acquiring or merging a company without comprehensive due diligence is like travelling without a map, where you may be led astray by unforeseen roadblocks and detours. Thorough cultural due diligence will show you red flags or areas where you are not on the same page with the other party.

So, conduct due diligence and avoid significant losses and risks due to incompatibility that Daimler-Benz and Chrysler didn’t manage to prevent.

2. Communication

Silence can be detrimental during an M&A, as it can breed fear and uncertainty. On the other hand, communication encourages trust and can help build a positive relationship between the employees and the management. Therefore, keep the lines of communication open, address concerns, and be transparent about the process.

When starting an M&A, communicate the reasons for the deal, its impact on employees, and the expected cultural changes.

3. Leadership

Leaders play a crucial role as not only decision-makers but also as cultural ambassadors in M&A. They are responsible for effectively communicating the shared vision and exemplifying the new cultural norms. When leaders consistently act according to their words, it builds a trust bridge between them and the employees, increasing the likelihood of employees accepting the change and following the new cultural norms.

Therefore, you must have an influential leader who strengthens intercultural synergies.

4. Training

Intercultural training is like a classroom where employees can master the language of other cultures. With it, they gradually get used to each other’s traits and preferences, reducing the risk of misunderstandings due to cultural differences.

Conduct seminars, interactive workshops, and team-building activities to help your team understand the new environment and adapt to it painlessly.

5. Engagement

Involving all employees in the integration process can go a long way in establishing strong relationships and cultivating a sense of unity. This approach allows your employees to feel like they are making a valuable contribution and playing a pivotal role in decision-making.

Create cross-cultural teams or committees and encourage active member participation.

6. Monitoring

It’s difficult to say where the culture integration ends because it requires constant monitoring and control. For example, employees may understand each other today, but cultural differences can arise unexpectedly and create conflicts tomorrow.

So, conduct regular assessments within a team to identify current problems or points of resistance and prevent any culture-related risks for your merged company.

Why does culture matter in M&A?

Cultural mismatches can lead to problems during the post-merger integration process, including the following:

❗ Employee resistance. Employee productivity, engagement, and morale can suffer due to clashing work styles and values. As a result, a company risks derailing the integration due to low commitment from team members or even their departure from the company.

❗ Leadership and management conflict. Different decision-making approaches and management methods can provoke serious conflicts and disrupt integration. That’s why keeping communication open and transparent in all business aspects is critical.

❗ Cultural dilution. Attempts to assimilate different cultures too quickly can result in the loss of their uniqueness, which provokes a decrease in employee satisfaction and talent attrition. Therefore, it is crucial to approach cultural assimilation with sensitivity and respect, allowing each culture to maintain its identity.

Conclusion

The cultural aspect of successful mergers and acquisitions is just as important as any financial factor. Therefore, we recommend considering world-famous companies’ experiences and using our tips to avoid falling into “cultural” traps!