Jump in current conditions fuels sentiment

Virginians weighed in on their opinion of the economy for the third time this year. The Roanoke College Poll interviewed 603 Virginians about their financial situation, general business conditions now and in the future, their inclination for purchasing durable goods, and their thoughts on prices in the near- and long-term. This is the tenth survey from IPOR on Virginia consumer sentiment and the ninth for inflation expectations. As of 2013, both measures are released quarterly.

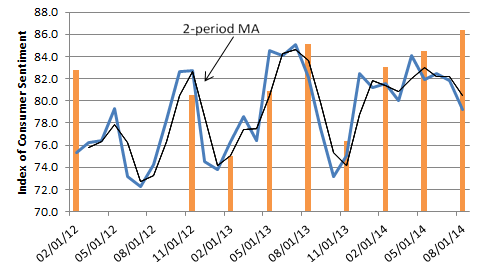

The Virginia Index of Consumer Sentiment (VAICS) rose to 86.4 in August, up 1.9-points since May 2014, the highest value recorded since the index began almost three years ago. The increase continues the upward trend held through the middle of 2013, with the exception of a drop in November 2013. Sentiment in Virginia is considerably higher than the August preliminary national consumer sentiment value of 79.2.

The Virginia Index of Consumer Expectations (VAICE) is 82.9 in August, down slightly from 84.7 in May 2014. The preliminary August 2014 national measure of expectations is 66.2 indicating that Virginians are considerably more optimistic about the future of the economy than the nation as a whole. The share of respondents who believe that their personal finances will be strong next year is down 6-points since May.

Democrats (49 percent) and blacks (48 percent) are more likely to believe the coming years will be a time of personal prosperity. Thirty-four percent of Virginians expect economic prosperity and growth over the next five years, particularly Democrats (43 percent), low-income (45 percent), and high-income (42 percent) households.

Virginians report being better off financially today than a year ago and that business conditions have strengthened. The Virginia Index of Current Conditions (VAICC) is 91.7, up 7.5 points since May 2014. Thirty-four percent report improved household finances from a year ago. Of those reporting being better off financially today compared to a year ago, over 69-percent attribute the improvement to higher income, while only 4.4-percent to lower prices.

Other reasons given for doing better today include increased hours of work and lower personal debt. Of those who report being worse off financially today compared to a year ago, 28.8 percent attribute it to lower income and 33.3 percent blame higher prices; both shares are lower than reported in May 2014. Additionally, poor health, rising health care costs, loss of health insurance, and job loss are culprits in worsening household circumstances.

The nation as a whole is considerably more positive about the current conditions. The Virginia-US gap concerning current conditions has persisted since 2013, perhaps due to the labor market and budgetary effects of sequestration. Thirty-five percent of Virginians believe that business conditions are worse today than a year ago, a one-point increase since May; thirty-three percent report business conditions have improved, up seven points since May. Republicans (51 percent) and whites (40 percent) are considerably more likely to believe that business conditions have worsened in the past year. Comparatively, Democrats (44 percent) and blacks (42 percent) are more likely to consider the economy improved over the year. Figure 2 shows the three indexes for both Virginia and the United States.

Improved sentiment in the Commonwealth could stem from a variety of sources. Negative reports of international unrest, stagnant real wages, and volatile stock markets are balanced by positive reports of steady labor markets and stable gas prices. However expectations appear tempered due to anticipated state tax increases and budget cuts, a result of the Commonwealth’s projected $2.4 billion budget gap.

Southwest Virginia reported a 10-point increase in current conditions potentially due to a series of recent announcements. Volvo recently announced that it will invest $69 million in new equipment and hire 200 additional workers at their Dublin facility. On Aug. 12, the truck plant opened a one-mile test track that generated considerable press and is hoped to increase business. Grayson (Hansen Turbine), Smyth (Mayville Engineering), and Carroll (Vanguard Furniture) counties also will see business investments and new jobs. Sentiment rose in the region despite increases in the local unemployment rate over the summer. Roanoke and Blacksburg recorded a combined 1,900 job losses in June.

The short-term inflation expectation is up two basis points to 3.3 percent and is one basis point lower than the national preliminary expectation value. The long-term inflation expectation continues to fall; the value is currently 4.2 percent, down from 5.2 percent in November 2013. The value is still above the November 2012 low of 3.6 percent. Stable fuel prices likely play a role in the expected disinflation. Both short- and long-term inflation expectations are fairly stable. Predictable prices are crucial to long-run economic growth and job creation.

Methodology

Interviewing for The Roanoke College Poll was conducted by The Institute for Policy and Opinion Research at Roanoke College in Salem, Va., August 11-15, 2014. The sample consisted of 603 residents of Virginia.

A copy of the questions and all frequencies may be found here.