Virginians weighed in on their opinion of the economy for the third time this year. The Roanoke College Poll interviewed 604 Virginians about their financial situation, general business conditions now and in the future, their inclination for purchasing durable goods, and their thoughts on prices in the near- and long-term.

Sentiment continues to rise despite falling national sentiment

The Virginia Index of Consumer Sentiment (VAICS) rose to 85.1 in August, a 5 percent increase since the second quarter of 2013 and more than a 13 percent rise for the year. This marks the highest sentiment value since November 2011, the first time the measure was reported. The preliminary national August value is 80.0, a retreat from its upward trend. August marks the first time since November 2012 that Virginia sentiment exceeds that of the U.S.

Positive sentiment about the future economy and household finances grew, albeit at a slower pace from earlier in the year. More than 36 percent of those surveyed in Virginia believe their finances will improve over the year, and more than 41 percent expect improving business conditions. Thirty-three percent of Virginians believe that the next five years will be a time of prosperity, while 37 percent anticipate that it will be a period of economic recession.

Virginians also report improved household finances and business conditions since a year ago. Thirty-five percent of Virginians report their household finances are better now than a year ago; close to half of households express that now is a good time to buy large durable goods.

The growth rates of all sentiment measures slowed in Virginia, compared with the second quarter of 2013. This is likely due to several offsetting economic issues. On the positive side, more than 65 percent of respondents report improvements in the real estate market over the past year and close to 55 percent expect improvements in the coming year.

According to Zillow.com, Virginia’s Home Value Index increased 4.2 percent over the past year, while the median sale price of Virginia homes increased by more than 26 percent, 77 percent of which sold for a gain. Rising home prices increase the wealth and sentiment of home owners.

The labor market is likely the most significant burden on Virginia sentiment. State unemployment increased from 5.3 percent to 5.7 percent between May and July. Over the same period, the labor force contracted by 3,500 individuals. The biggest job losses were in construction, manufacturing, education and health services and government. Significant growth in employment was seen in the financial activities and professional services industries.

Additionally, interest rates are on the rise nationally and in the Commonwealth. The average 30-year fixed-rate mortgage on Aug. 18 was 4.49 percent in Virginia, up 15 basis points from the week before and up nearly 100 basis points since May, making it increasingly expensive to borrow money to buy a home.

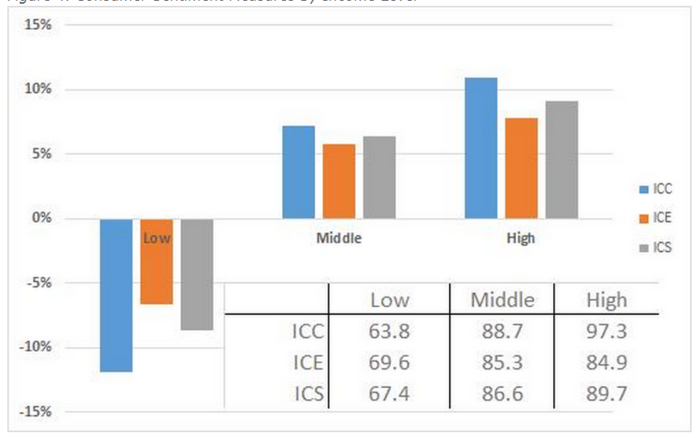

Finally, sentiment varies dramatically across income levels. Low income households (<$20,000) are significantly more pessimistic about their finances and the economy, both today and into the future. The VAICC fell by 12 percent for this group since May suggesting that these households are feeling the brunt of the struggling labor market.

Middle ($25,000-$75,000) and high (>$75,000) income households are considerably more favorable about the economy, particularly the current conditions. It is likely that these groups are the ones receiving the benefits of a strong stock market and rising housing prices.

Northern Virginia and Tidewater continue to lead, Southwest concerned about future

Disparities in consumer opinion persist across the Commonwealth. The VAICS increased in all regions, led again by Northern Virginia (NOVA) and the Tidewater with VAICS’s of 91.3 and 88.1, respectively. The largest gains in consumer sentiment were in the Shenandoah Valley (+12 percent) and Central Virginia/Richmond (+9 percent).

All regions are particularly high on current conditions, except the Southside. The leaders in the VAICC were NOVA (94.7) and the Tidewater (89.7); the largest gains in the VAICC were in the Shenandoah Valley (+19 percent) and Central Virginia/Richmond (+11 percent).

The optimism in NOVA and the Tidewater continue despite the sequester cuts that were to hit the two regions the hardest due to a heavy reliance on government spending and contracts. Job growth in the Tidewater has slowed some but remains strong. The port experienced its best fiscal year ever, with container traffic up 10 percent year-over-year in June.

In contrast, the Southside recorded an 11 percent decline in its VAICC, likely related to its lagging labor market. More than 52 percent of those in the Southside say that their household is financially worse off today than a year ago.

The VAICE in Southside, Southwest, and the Shenandoah Valley continue to trail the rest of the Commonwealth. Close to half of Southwest respondents reported that they believe the next five to 10 years will be a period of economic recession and high unemployment, which is almost 15 percentage points higher than the state as a whole. In contrast, close to 45 percent of those in the Tidewater believe the near future will be a period of economic prosperity.

Short-term and long-tern inflation expectations unchanged

Short-term inflation expectations held firm since the first quarter of 2013 at 3.5 percent. Almost 65 percent of Virginians believe that prices will rise in the next year, though slightly lower since the second quarter of 2013.

In contrast, national short-term inflation expectations have not been above 3.5 percent since August 2012 and were 3.1 percent in July 2013. Meanwhile, long-term inflation expectations in Virginia remained at 5 percent in the third quarter of 2013. Eighty-four percent of survey respondents believe that prices will rise in the next five to 10 years, a value that is not statistically different from the second quarter of 2013.

Interviewing for The Roanoke College Poll was conducted by The Institute for Policy and Opinion Research at Roanoke College in Salem between August 5-12, 2013. The sample consisted of 604 residents of Virginia.